In order to understand the application of the Malta VAT on yachts, let us see the general legal framework, the step-by-step checklist and a practical example.

VAT Treatment of Malta Yachts: Legal Basis

Malta yacht VAT regime is regulated by national and EU legislation, namely:

- VAT Act (Cap. 406)

- Council Directive 2006/112/EC

- Council Implementing Regulation 282/2011ECJ case law

Malta Yachting VAT: Checklist

By going through the questions below, you will be able to eventually define the yachting VAT treatment in a particular scenario:

1. Who is carrying out the transaction and for whom?

| TAXABLE PERSON | NON-TAXABLE PERSON | NON-TAXABLE LEGAL PERSON |

| any person who, independently, carries out in any place, any economic activity, whatever the purpose or results of that activity | any person who is not a taxable person | any person, other than a physical person who is not a taxable person |

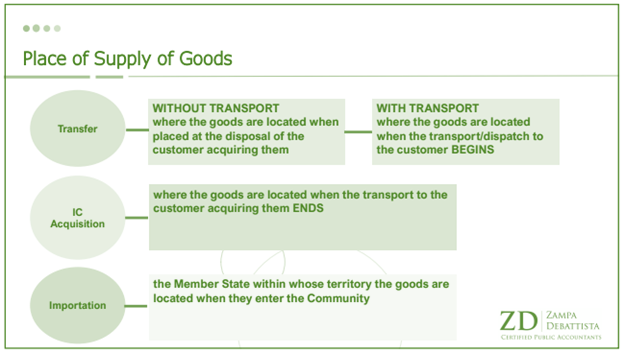

2. What is the nature of the operation?

| GOODS | SERVICES |

| Transfer | Hiring of a means of transport |

| Intra-Community acquisition | Passenger transport |

| Importation | Management or operating |

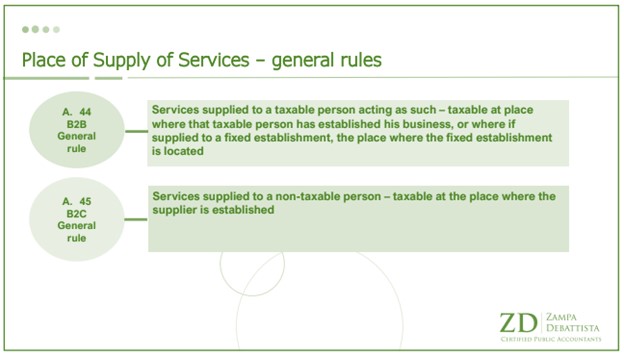

3. What is the place of supply?

The place of supply is the tax jurisdiction where a particular yachting transaction falls to be taxed on the basis of the nature of the supply and the tax status of each of the parties involved.

Not sure what is the place of supply in your case?

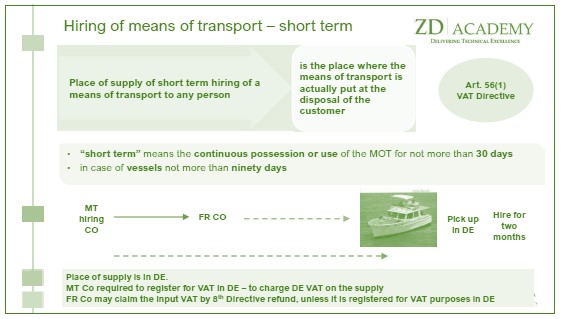

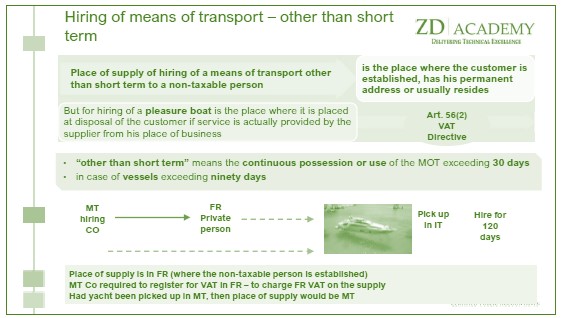

Specific place of supply rules for hiring (chartering) of yachts:

4. Does any exemption apply?

There are the following VAT exemptions for yacht supplies made in Malta:

- supply of (qualifying) sea vessels;

- supply of equipment incorporated or used therein (to constructors, owners or operators only);

- services of modification, maintenance, chartering and hiring or equipment referred to the above point;

- services for the direct needs of the sea vessels; for the direct needs of their cargo; assistance to passengers or crew for the account of the shipowners.

The use and enjoyment clause as applied in Malta

Malta applies the use and enjoyment provision of the VAT Directive (Art. 59a) whereby, under certain terms and conditions, where a pleasure boat is chartered long-term the actual use and enjoyment of the pleasure boat outside EU territorial waters is treated as VAT exempt.

Malta Yacht Leasing

The beneficial VAT yacht leasing regime in Malta stands for a long-term charter of a pleasure boat, whereby the VAT incurred on the purchase of the pleasure boat will be deducted immediately and then paid with the lease instalments over the period of the long-term lease.

Do you want to learn more about each of the exemptions and check whether you qualify?

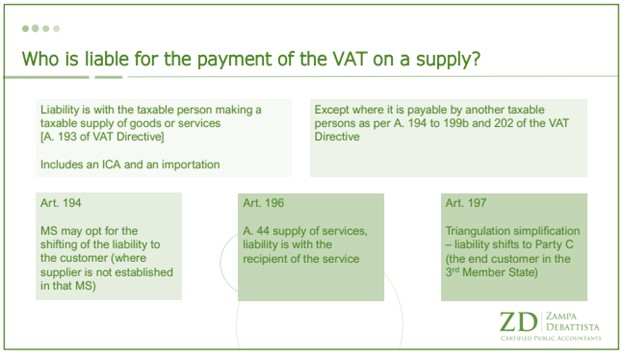

5. Who is liable to pay Malta VAT on Yachts?

Are you struggling to define who is taxable and to which extent?

Malta VAT on Yachts: Practical Case Study

VAT Scenario:

Sunwater Ltd. is a company established in Malta. It is the go to company for chartering of vessels. In certain instances it acquires vessels itself from Italy which it charters for less than 40 days to private individuals. It parks its vessels in Marinas in Italy, Monaco and Malta. Its customers are business owners who are in the business of chartering. They charter in and then charter out vessels to private consumers. Sunwater would like to understand the VAT implications of all its purchases and sales transactions.

VAT analysis (purchases):

| Who is supplying to whom? | B2B |

| Nature of supply | Intra-Community acquisition |

| Where to tax? | Where the transport ends Malta, Italy France |

| Exemption? | N/A unless the supplier knows exactly that the vessel will be chartered to a business who will use it for navigation purposes on the high seas |

| Who is liable to pay the VAT? | In terms of A200, the person making the acquisition |

VAT analysis (sales):

| Who is supplying to whom? | B2B | B2C |

| Nature of supply | Short-term chartering of vessels | Short-term chartering of vessels |

| Where to tax? | Malta, Italy, France | Malta, Italy, France |

| Exemption? | If in Malta, possibly if it meets the condition of the exemption | N/A |

| Who is liable to pay the VAT? | Supplier, unless A194 applies in MS of the customer in which case liability is shifted on the customer | Supplier |