Following the introduction of the VAT Grouping legislation in Malta, we can conclude that this important regime has provided licensed operators with a fiscal tool aimed at improving their cashflow position and, in certain instances, optimising their VAT situation. We have seen a successful take up among companies operating in the financial services and gaming sectors following the enactment of Malta VAT grouping.

VAT Grouping Benefits

The main benefit of the VAT grouping regime is that any charges between members of the VAT group are disregarded and therefore no output is charged on any supplies made between the members. Also, there will be one VAT number in Malta for the VAT Group and one Malta VAT return needs to be submitted which would include all transactions of the group.

VAT Grouping Eligibility

Two or more persons established in Malta may apply to the Commissioner to be registered as a single taxable person for the purposes of the VAT Act if the following VAT grouping conditions are satisfied:

(a) at least one of the applicants is a taxable person who is licensed or recognised in terms of any one of the following acts:

- The Banking Act

- The Financial Institutions Act

- The Gaming Act

- The Insurance Business Act

- The Insurance Distribution Act

- The Investment Services Act

- The Lotteries and Other Games Act

- The Retirement Pensions Act

- The Securitisation Act

(b) each of the applicants is bound to each of the others by financial links, organisational links and economic links; and

(c) at the time of application, all the applicants have submitted all returns and notices due under articles 27 and 30 of the VAT Act, and all returns of income due in terms of the Income Tax Management Act, and have settled in full any and all amounts due by way of tax declared in the aforementioned returns and notices, as well as any interest and administrative penalties due pursuant to the Act and the Income Tax Act and Income Tax Management Act:

For the purposes of VAT Grouping in Malta

(a) the required financial links shall be deemed to exist where any two or more of the following are, directly or indirectly, held as to more than 90% by the same person or persons (whether a legal person or an individual):

- the voting rights or equivalent interests;

- the entitlement to profits available for distribution; or

- the entitlement to surplus assets available for distribution on a winding up or equivalent event.

(b) The organisational links shall be deemed to exist where the applicants have a shared management structure, whether in whole or in part;

(c) The required economic links shall be deemed to exist where the activity of each of the applicants is of the same nature or within the same industry, or where the activities of the applicants are interdependent or complementary, or where one member of the group carries out activities which are wholly or substantially to the benefit of any one or more of the other members.

Check your eligibility

VAT Grouping Registration

Application for VAT Grouping may be made through this link: https://taxation.gov.mt/taxationweblauncher/eidAuthPro/vatservices

Applicants must be in possession of a Malta VAT number. In case where a legal person does not have a VAT number it shall apply for a VAT Identification number. This VAT Identification number shall be exclusively used for VAT grouping purposes.

Once the VAT group is registered, all individual VAT numbers of the relevant members will be deactivated and a Group VAT Number will be issued.

VAT Grouping Anti-Avoidance

The Malta VAT grouping rules factor in any anti-abuse requirements which emanate from the landmark European Court of Justice decision in the Skandia case C-7/13.

VAT Grouping Application: Practical Scenarios

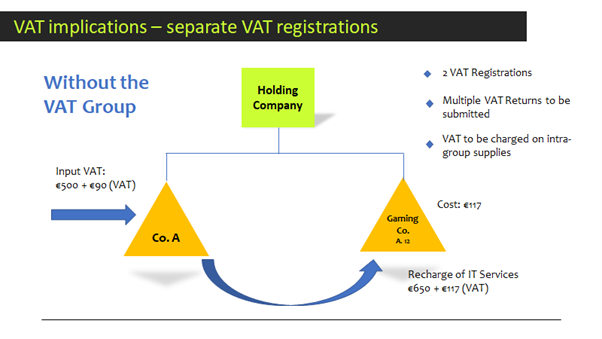

(i) Assumption – No VAT Group

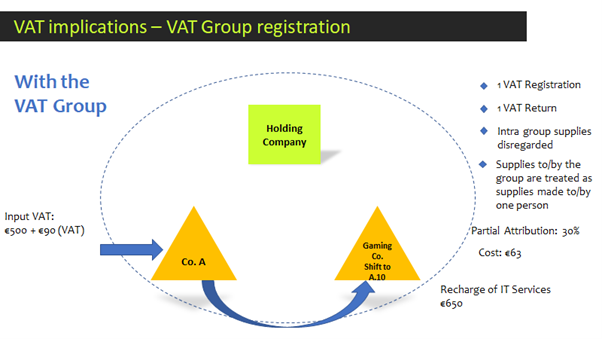

(ii) Assumption – VAT Group

VAT Grouping Consultation

Our experience with VAT Grouping and other relevant Malta VAT issues has enabled us to obtain the necessary competence vital for ensuring adherence with the local and European legislation.

Do you need expert advice on VAT grouping in Malta?