The European Union’s (EU) Taxonomy Regulation aims to facilitate the transition of the EU economy in alignment with the European Green Deal goals, including achieving climate neutrality by 2050. As a classification tool, it offers clarity for businesses, financial markets, and policymakers on sustainable economic activities. Additionally, as a screening tool, it aims to direct investment toward these activities.

What is the EU Taxonomy Regulation?

The EU Taxonomy Regulation establishes a comprehensive EU-wide classification system for environmentally sustainable economic activities. It provides a common language and clear definition of what constitutes ‘sustainable’, based on harmonised criteria across the EU. The Taxonomy Regulation is a fundamental component of the EU’s sustainable finance framework and a vital tool for market transparency. It guides investments towards economic activities crucial for the transition to sustainable investments, aligning with the European Green Deal objectives.

The EU Taxonomy also interacts with the Corporate Sustainability Reporting Directive (CSRD). Companies that report sustainability statements under the CSRD and are associated with the European Sustainability Reporting Standards (ESRS) must include information on how and to what extent their activities align with the environmentally sustainable economic activities defined by the EU Taxonomy, in a distinct section of their sustainability statements.

When Can Activities be Reported as Sustainable?

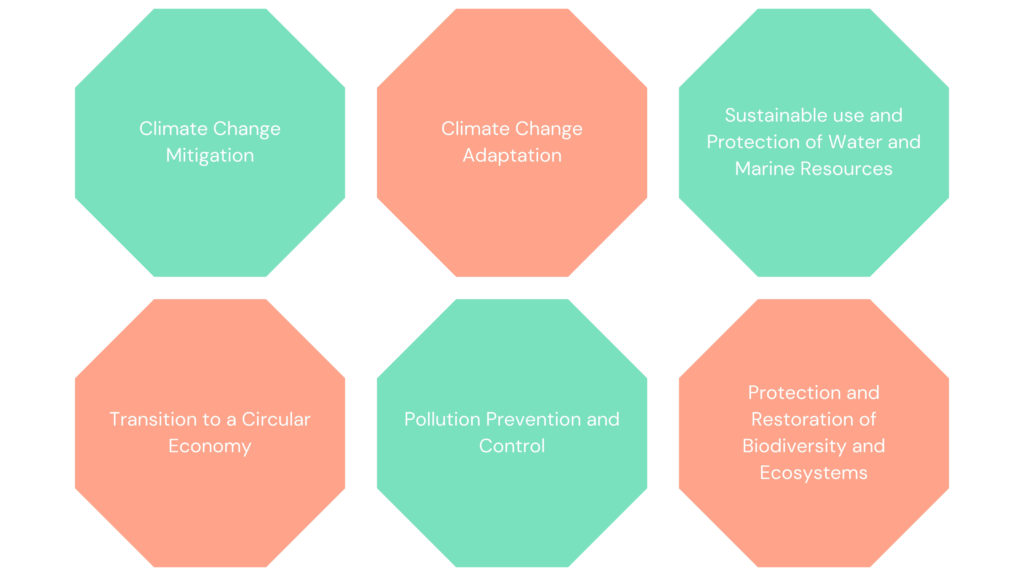

An organisation’s economic activities that generate turnover, capital expenditure (CapEx), and/or operating expenditure (OpEx) can be considered potentially sustainable if they are outlined in the Delegated Acts of the EU Taxonomy Regulation. These Delegated Acs detail the activities for each of the six environmental objectives identified by the European Commission, which are:

In the Taxonomy Regulation, environmentally sustainable economic activities are described as those which “make a substantial contribution to at least one of the EU’s climate and environmental objectives, while at the same time not significantly harming any of those objectives and meeting minimum social safeguards.”

The technical screening criteria establish the precise requirements and benchmarks for an activity to qualify as significantly contributing to a sustainability goal. To ensure an economic activity qualifies as environmentally sustainable, an activity must adhere to the ‘do no significant harm’ principle. For an activity pursuing one or more of the six objectives to be deemed sustainable, it must not cause significant harm to any of the other Taxonomy objectives. The technical screening criteria establish thresholds for each activity to define compliance with this principle. Additionally, activities must meet minimum social safeguards.

Enabling and Transitional Activities

Within activities that significantly contribute to one or more environmental objectives, this regulation identifies two categories which are enabling activities and transitional activities. These categories were introduced to include activities that might not typically be considered sustainable but still contribute to the overarching goal of promoting sustainability.

Enabling activities facilitate other activities in making a significant contribution to one or more of the Taxonomy’s six objectives. However, they must not result in a ‘lock-in’ of assets which would hinder long-term environmental goals. Additionally, enabling activities need to have a substantial positive environmental impact throughout their life cycle.

An example of an enabling activity would be a manufacturer of electric vehicles, which help reduce reliance on fossil fuels and support the transition to renewable energy by providing sustainable transportation and energy solutions.

Transitional activities must support climate change mitigation and align with the pathways to keep global warming in line with the Paris Agreement commitments. To qualify, transitional activities must meet the following criteria:

- There are no technologically or economically feasible low-carbon alternatives,

- Greenhouse gas emission levels are consistent with the best performance in the sector or industry,

- The activity does not result in carbon lock-in or obstruct the development and deployment of low-carbon alternatives.

An example of a transitional activity would be a company focusing on oil and gas, which invests in renewable energy projects such as wind, solar and biofuels.

Who Needs to Comply with the EU Taxonomy Regulation?

Companies that fall under the scope of the Taxonomy Regulation include financial market participants such as Alternative Investment Fund Managers (AIFM), credit institutions which provides portfolio management, manufacturers of pension products and investment firms which provide portfolio management, amongst others. Additionally, companies subject to the Taxonomy Regulation are those that fall under the scope of the Non-Financial Reporting Directive (NFRD) and CSRD. This includes the following:

- As of 1st January 2024, public interest entities employing more than 500 people,

- As of 1st January 2025, large companies that exceed two of the three criteria met:

- 250 employees,

- €25 million on the balance sheet,

- €50 million turnover.

- As of 1st January 2026, for listed SMEs,

- As of 1st January 2028, for certain non-EU companies that meet certain criteria.

Impact on Businesses

The Taxonomy Regulation presents an opportunity for businesses to showcase their performance and progress towards more sustainable business models, allowing financial markets to make better-informed investment decisions.

For organisations new to this concept, a good starting point would be to evaluate their business models and determine how much of their underlying qualify as ‘green’. This information is crucial for investors and insurers, as it will influence their own disclosures and investment decisions. The next step would be to ensure the company’s compliance with the minimum social safeguards which is achieved when economic activities are aligned with OECD’s Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

Starting this process as soon as possible is essential because depending on the assessment’s outcome, internal controls may need to be updated or replaced to meet new requirements. In extreme cases, a business model and corporate strategy may need to be adjusted or even reconsidered to ensure the company’s future viability.

How Can We Help

At Zampa Debattista we can help your organisation identify activities that contribute to environmental objectives outlined in the EU Taxonomy Regulation, ensuring accurate classification of sustainable economic activities. By leveraging our expertise, you can navigate the complexities of the taxonomy, demonstrate your commitment to environmental sustainability, and comply with regulatory requirements effectively.

Mark Wirth

Partner