The increased importance of Environmental, Social and Governance (ESG) matters is by no means a novelty, fuelled partially by society’s call for change as well as by the EU’s advancements on a legislative perspective. This article sets out the legislative point of departure and highlights the key developments that have taken place within the ESG sphere since then.

The Non-Financial Reporting Directive (NFRD)

The outgoing Non-Financial Reporting Directive (Directive 2014/95/EU) was adopted back in 2014 and came into force in the financial year ending in 2017. This Directive applies to large public interest entities (PIEs) that employ in excess of 500 employees, targeting approximately 11,700 large companies and groups across the EU.

The NFRD together with its follow -up non-binding reporting guidelines have been criticised for not catering for the quality of information which is nowadays demanded by users. The lack of guidance and assurance hinders the level of comparability and reliability of sustainability information which is reported.

Following the adoption of the 2015 Paris Agreement(1) on climate change and the United Nations Agenda for Sustainable Development (the ‘2030 Agenda’) which emphasises the Sustainable Development Goals, the European Commission has sought out a strategy which further connected finance with sustainability through its action plan “Financing Sustainable Growth”(2).

This article summarises the key legislative changes since the introduction of the NFRD.

The Corporate Sustainability Reporting Directive (CSRD)

The CSRD was issued in April 2021 and supersedes the NFRD. This is a major tool in the achievement of the European Green deal’s objectives which seek to transform the EU into a resource-efficient economy with zero net emissions of greenhouse gasses by 2050.

This proposed revision seeks to improve companies’ accountability and transparency when reporting their own impact on the environment and people through providing reliable, comparable, relevant and understandable information. The adjustments which take place through the CSRD aim to improve clarity in the disclosure requirements which apply in specific circumstances.

The principal changes which are expected to be brought about by the CSRD are:

- Reporting requirements have been extended to additional companies, including all large companies and EU listed companies except listed micro-companies.

- All companies within its scope are required to seek limited assurance for reported information. The CSRD also includes an option to require reasonable assurance at a later stage.

- The information requirements for companies within its scope is specified in greater detail through making reference to mandatory EU sustainability reporting standards, such as those currently being developed by the International Sustainability Standards Board (ISSB) and European Financial Reporting Advisory Group (EFRAG).

- Requires all information to be published within companies’ management reports and disclosed in machine readable format.

A company is considered to be ‘large’(3) when two of the following three criteria are met:

- It employs more than 250 employees on average during the financial year;

- Its balance sheet total exceeds 25 million euros;

- It generates a net turnover in excess of 50 million euros.

The introduction of the CSRD is expected to make it mandatory for approximately 49,000 companies within the EU to report and disclose critical non-financial ESG related information, representing a significant increase from the 11,700 companies previously targeted by the NFRD. The increase in targeted companies required to report should substantially increase ESG disclosures within the EU and is expected to bring about a greater emphasis on people and the environment.

The introduction of value chain reporting requirements is expected to require all entities, that transact significantly with entities that fall within the scope of the CSRD, to report ESG data in line with the directive. Reporting requirements include a double materiality perspective, meaning that disclosures should provide the necessary information to understand the entity’s impact on sustainability matters, as well as the impact that sustainability matters are creating on the achievement of the entity’s goals. This shall include both a retrospective and a forward-looking application through qualitative and quantitative information, including information which considers an entity’s value chain.

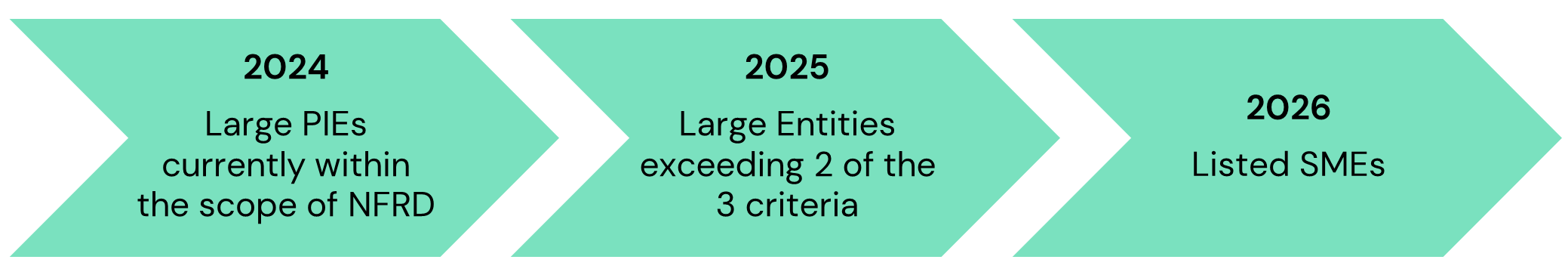

The proposed changes are expected to be implemented in a stepped approach, primarily applying to entities which are already within the scope of the NFRD from the 1st of January 2025 reporting for the 2024 financial year. Then applying to large companies not presently subject to the NFRD from the 1st of January 2026 reporting for the 2025 financial year, followed by listed Small and Medium-sized Entities (SMEs) on the 1st of January 2027 reporting for the 2026 financial year.

The Sustainable Finance Disclosure Regulation (SFDR)

The SFDR aims to improve transparency in sustainability risks and sustainable investment opportunities. The SFDR sets out disclosure requirements for a broad range of financial market participants (such as banks, asset managers, insurance companies etc) financial advisors and financial products, strengthening the sustainability disclosure obligations towards the end users.

The SFDR’s application came into force on the 10th March 2022, seeking to provide harmonised Union rules on sustainability-related disclosures regarding the extent to which sustainability risks are integrated in investment decisions or investment advice, the consideration of adverse sustainability impacts, and sustainability related information for financial products. In ensuring compliance with the SFDR, it is essential to distinguish between the financial products which promote environmental or social characteristics, and those which have as an objective a positive impact on environment and society, given that separate requirements have been specified for these categories.

The SFDR mandates for the development of Regulatory Technical Standards (RTS) by the European Supervisory Authorities (ESAs). The RTS provide further clarification on the content, methodologies and presentation of sustainability-related disclosures which came into force on the 1st of January 2023, in line with the Level 2 reporting requirements for the SFDR.

EU Taxonomy

As a tool to ease the transition to a modern, resource efficient and competitive economy, the EU taxonomy is the EU’s attempt to create an EU-wide classification system for sustainable activities, improving the ability of investments to be directed towards sustainable projects. In an attempt to define what is ‘sustainable’, the taxonomy establishes six environmental objectives:

- Climate Change Mitigation;

- Climate Change Adaptation;

- Sustainable use and protection of water and marine resources;

- Transition to a circular economy;

- Pollution prevention and control;

- Protection and Restoration of biodiversity and ecosystems.

To ensure reliability and comparability of sustainability-related disclosures the Taxonomy Regulation requires supplementary delegated acts establishing detailed technical screening criteria for the determination of whether a specific economic activity contributes substantially to one of the environmental objectives whilst not causing any significant harm to the other environmental objectives. The EU Taxonomy is a constantly developing framework with an increasing coverage of economic activities.

The Bigger Picture

The strengthened regulatory coverage shows the current drive for improved ESG disclosure requirements in the interest of inclusion of the masses within sustainable development. The resultant information will allow for a better-informed distribution of finance as well as provide a tool for fiscal measures and incentives. These legislative efforts will only succeed if complemented with a change in mindset across all levels in the integration of ESG within organisational strategies.

-

- Approved by Council Decision (EU) 2016/1841 OF 5 October 2016

- The renewed sustainable finance strategy and implementation of the action plan: Financing Sustainable Growth (8 March 2018) set out a strategy which further connected finance with sustainability through ten key action points

- Directive 2013/34/EU definition of a large entity

Mark Wirth

Partner