The importation of goods into the EU Community generally necessitates the immediate payment of VAT and import duties before those goods can be released by the Customs Authorities into free circulation. The VAT paid to the Customs Authorities, by a taxable person is not foregone as it can be claimed back through the periodic VAT returns, to the extent that, those goods form part of an economic activity which gives rise to a right of deduction.

On the other hand, where a person imports high value assets for private use such as vessel or aircraft, VAT is in principle payable immediately at Customs which unless is paid, may create a limitation on the freedom of movement of the vessel / aircraft within the EU Community.

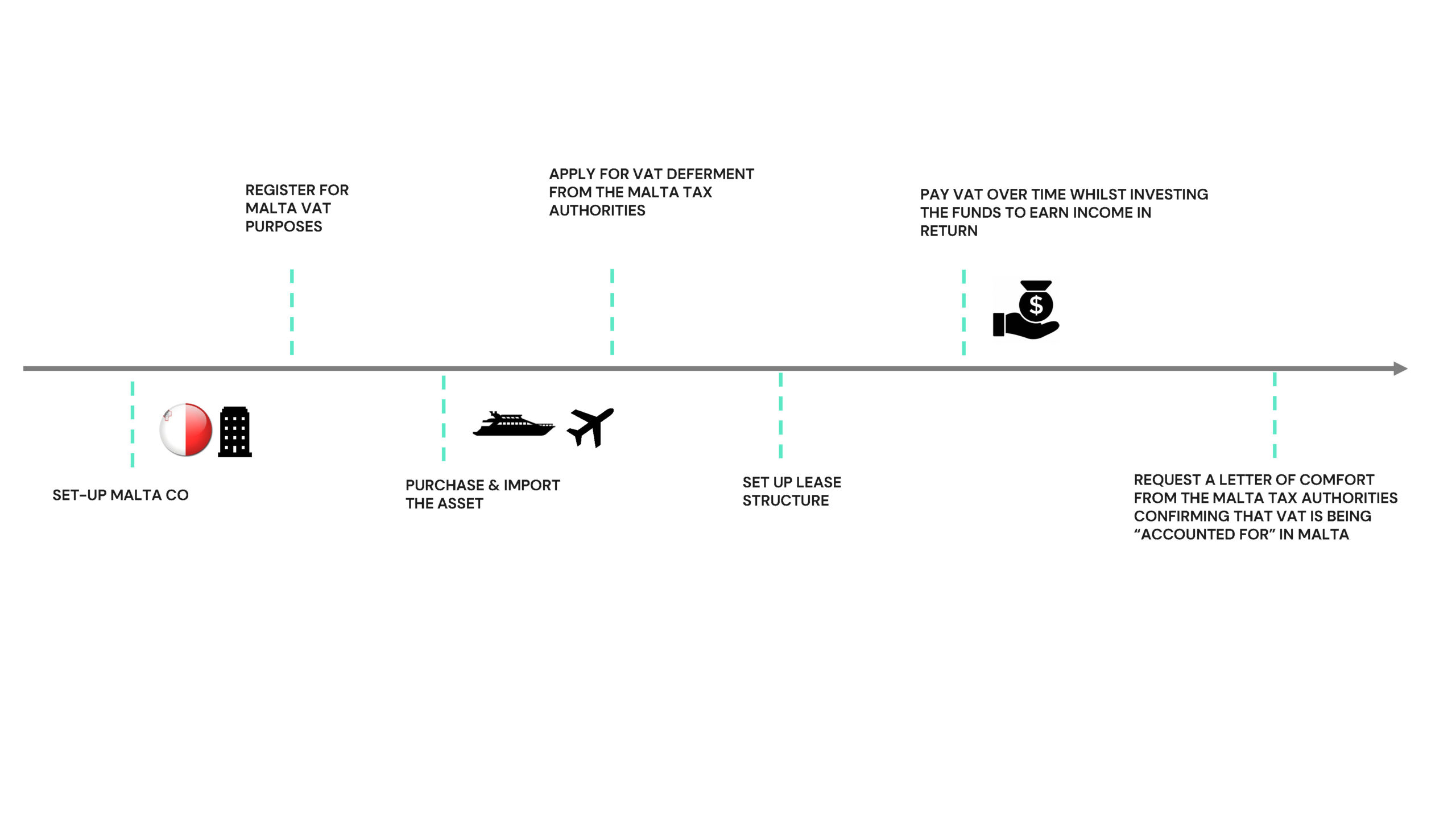

An importation followed by a leasing agreement would, to the extent that the relevant criteria is satisfied may benefit the importer from a deferment of the import VAT. Naturally this will be beneficial from a cash flow perspective since there would not be a lag between the immediate payment and the recovery of the VAT via the Malta VAT return.

Malta offers two practical leasing arrangements; one based on the effective “use and enjoyment” clause laid down in Article 59a of Council Directive 2006/112/EC whilst the other is based on the principles enshrined in the landmark case of the European Court of Justice (“ECJ”), the Weald Leasing Case C-103/09.

According to the ECJ, the adoption of an asset leasing structure involving the deferment of VAT over the useful life of an asset does not generate any tax advantages and is not considered as abusive, provided that, the contractual terms of those transactions, particularly those concerned with setting the levels of lease payments, correspond to arms’ length terms.

What are the steps in an asset leasing arrangement?

VAT Paid Status

The term “VAT Paid” is not defined in the VAT legislation however, it defines the status of an asset which allow it to roam freely within the EU Community. An owner of an asset can prove such status through documentation such as a VAT Paid Certificate, tax invoice / fiscal receipt, Customs import documents, confirmation of payment to the Tax Authorities etc.

The VAT Paid status can easily be lost if the asset is exported outside the EU Community and does not return within 36 months or else, the asset is exported and reimported by a person different from the exporter.

As mentioned above, in certain Member States the VAT paid status is typically supported by the VAT Paid Certificate which is a document issued by authorities of a Member State which certifies that VAT on a particular asset has been paid.